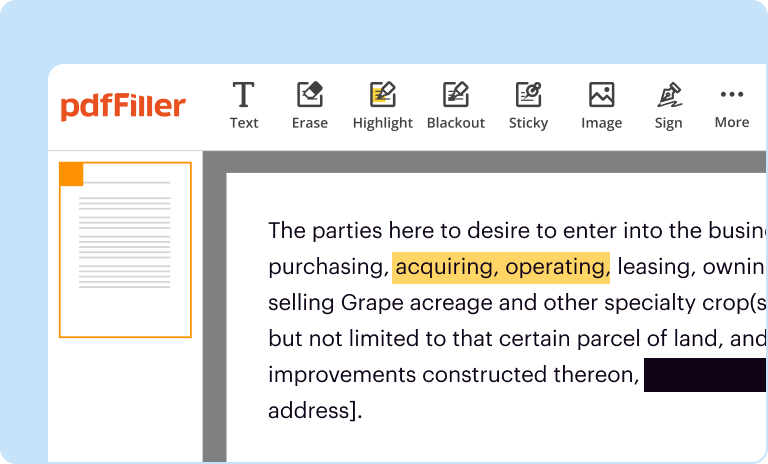

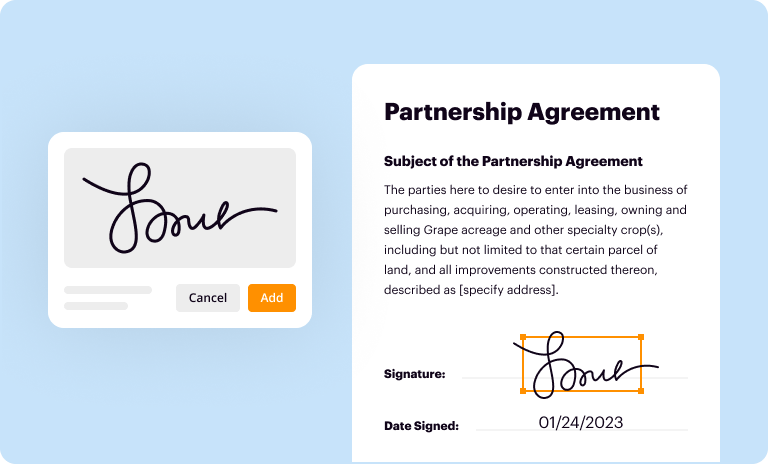

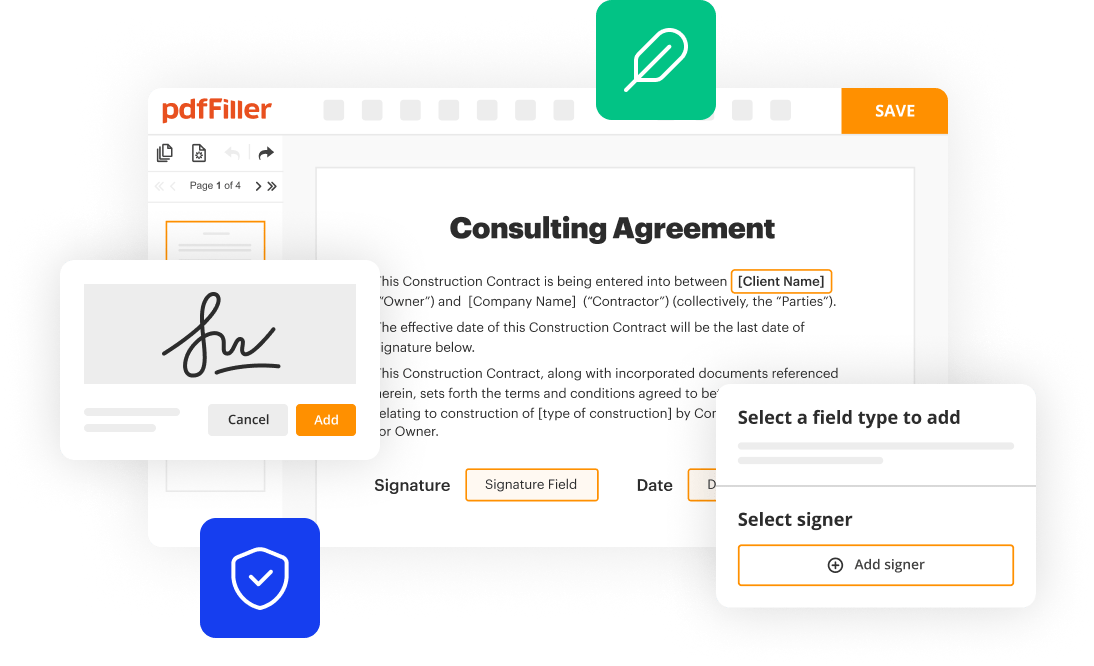

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

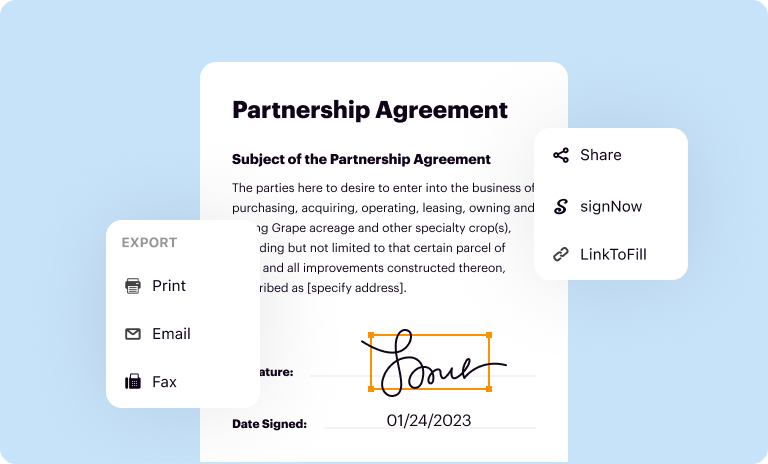

Email, fax, or share your bruma finance photos form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

Edit brumafinance form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Individuals who are willing to provide the necessary documentation and meet the loan requirements set by Bruma Finance.

We know you're all eager for news on the progress of our first content release beyond Skyrim Burma, and we're deeply thankful for your patience today we're pleased to make a very exciting announcement while Burma has been in an internal beta phase for a while today we're thrilled to announce that Burma has reached a stage of development where its content complete that is to say every piece of content is implemented and playable quests 2 dungeons 2 exterior locales and now drama enters its next phase of development testing bug fixing and polish it's for this reason that we're very pleased to announce that we're opening sign-ups to the public to get involved in testing the beta as we proceed toward release there's a simple application form to fill out to be considered for the process so if you're interested complete it and submit it to register your interest, and we'll be in touch shortly if you're selected we'll be listening very intently to the feedback of our testers during this process working with you to not only fix bugs also to get your opinions on the overall experience thank you very much for your patience everyone it's a thrill to be so close to finishing aroma and sharing with you all an experience that's been so many years in the making [Music] [Music] [Music] you

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bruma finance loan application?Bruma Finance Loan Application is the process of applying for a loan from Bruma Finance, a financial services company offering personal loans to individuals in South Africa. The loan application can be done online or in-person, and requires filling out an application form with personal and financial information. Bruma Finance assesses the application, including credit checks, to determine the loan amount and interest rates. If approved, the loan amount is disbursed to the applicant, who then repays it over a specified period with interest.

Who is required to file bruma finance loan application?Bruma Finance loan application is required to be filed by individuals who are seeking a loan from Bruma Finance.

How to fill out bruma finance loan application?To fill out a Bruma Finance loan application, follow these steps: 1. Visit the Bruma Finance website: Go to the official Bruma Finance website (brumafinance.co.za). 2. Find the loan application form: Look for a link or section on the website that says "Apply now" or "Loan application." Click on it to access the loan application form. 3. Provide personal information: Fill in your personal details, including your full name, date of birth, ID number, gender, marital status, and contact information (phone number and email address). If applicable, provide information about your spouse or partner. 4. Residential information: Indicate your current residential address and the duration of your stay at that address. If you have lived at your current address for less than three months, provide your previous address as well. 5. Employment details: Enter your employment information, including the name of your employer, your job title, employment status (e.g., permanent, contract), length of employment, and monthly income. If you are self-employed, provide details about your business. 6. Bank account details: Specify the bank you hold your primary account with and provide necessary details, such as the account number and branch code. 7. Loan details: Select the loan amount you want to apply for and the repayment term that suits you. Read the terms and conditions associated with the loan carefully before proceeding. 8. Consent and declaration: Confirm your consent to Bruma Finance collecting and processing your personal information provided in the loan application. Agree to their terms and conditions and privacy policy. 9. Submit the application: Review all the information entered in the application form for accuracy. Once you are satisfied, submit the loan application. 10. Await response: Bruma Finance will review your application and contact you regarding its acceptance or any further documentation that might be required. Be sure to provide any additional documents promptly to speed up the loan approval process. Note: Always double-check the accuracy of the information you provide in the loan application, as any inaccuracies could lead to delays or rejection of your application.

What is the purpose of bruma finance loan application?The purpose of the Bruma Finance loan application is to apply for a loan from Bruma Finance, a financial institution. This application allows individuals to request a loan amount, provide necessary personal and financial information, and go through an evaluation process to determine eligibility for the loan. The loan can be used for various purposes such as personal expenses, debt consolidation, home improvements, or business investments, depending on the specific loan products offered by Bruma Finance.

What information must be reported on bruma finance loan application?When applying for a loan with Bruma Finance, the following information is typically required: 1. Personal Details: This includes your full name, date of birth, nationality, marital status, and identification information such as a valid ID, passport, or driver's license. 2. Contact Information: Your current residential address, email address, and phone number. 3. Employment Details: Your employment status (employed, self-employed, retired), employer's name, work address, job title, and length of employment. If self-employed, you may need to provide additional financial documentation. 4. Financial Information: This includes details about your income, such as salary, bonuses, or any other forms of income. You may also need to disclose details of other assets, investments, debts, and liabilities. 5. Loan Details: You should provide the requested loan amount, the purpose of the loan, and the desired loan term. 6. Bank Information: You may be asked to provide your banking details, including the name of your bank, branch address, account number, and how long you have held the account. 7. References: Some loan applications require personal or professional references for verification purposes. These references should typically be individuals who can vouch for your character and reliability. It is important to note that the specific information required may vary depending on the loan amount, terms, and company policies. Therefore, it is always advisable to review the loan application carefully and provide all the necessary information accurately.

Where do I find bruma finance loans online?It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the bruma finance contact details in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in bruma finance online application without leaving Chrome?Install the pdfFiller Google Chrome Extension in your web browser to begin editing bruma finance loan application and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out bruma finance loan calculator on an Android device?On an Android device, use the pdfFiller mobile app to finish your please tell me about bruma finance. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Get started now

To request a personal loan at Bruma Finance you will need to fill in an online form providing Bruma with your personal information and wait for Bruma to contact . Rating: 4.3 · 3 reviews

END OF PROJECT REPORT10 Sept 1996 — The reference group consisted of key public and private sector individuals, particularly those from financial institutions/investment companies.

Bruma-finance-loan-calculator | LoansNov 4, 2015 . It is for this reason that Bruma Finance Loan Calculator go out of their way to assist their clients and lighten the load as best as they can.